Page 102 - รายงานประจำปี 2565 สสว

P. 102

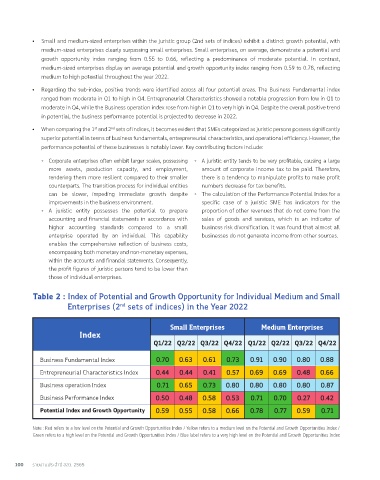

• Small and medium-sized enterprises within the juristic group (2nd sets of indices) exhibit a distinct growth potential, with

medium-sized enterprises clearly surpassing small enterprises. Small enterprises, on average, demonstrate a potential and

growth opportunity index ranging from 0.55 to 0.66, reflecting a predominance of moderate potential. In contrast,

medium-sized enterprises display an average potential and growth opportunity index ranging from 0.59 to 0.78, reflecting

medium to high potential throughout the year 2022.

• Regarding the sub-index, positive trends were identified across all four potential areas. The Business Fundamental index

ranged from moderate in Q1 to high in Q4. Entrepreneurial Characteristics showed a notable progression from low in Q1 to

moderate in Q4, while the Business operation index rose from high in Q1 to very high in Q4. Despite the overall positive trend

in potential, the business performance potential is projected to decrease in 2022.

• When comparing the 1 and 2 sets of indices, it becomes evident that SMEs categorized as juristic persons possess significantly

st

nd

superior potential in terms of business fundamentals, entrepreneurial characteristics, and operational efficiency. However, the

performance potential of these businesses is notably lower. Key contributing factors include:

◦ Corporate enterprises often exhibit larger scales, possessing ◦ A juristic entity tends to be very profitable, causing a large

more assets, production capacity, and employment, amount of corporate income tax to be paid. Therefore,

rendering them more resilient compared to their smaller there is a tendency to manipulate profits to make profit

counterparts. The transition process for individual entities numbers decrease for tax benefits.

can be slower, impeding immediate growth despite ◦ The calculation of the Performance Potential Index for a

improvements in the business environment. specific case of a juristic SME has indicators for the

◦ A juristic entity possesses the potential to prepare proportion of other revenues that do not come from the

accounting and financial statements in accordance with sales of goods and services, which is an indicator of

higher accounting standards compared to a small business risk diversification. It was found that almost all

enterprise operated by an individual. This capability businesses do not generate income from other sources.

enables the comprehensive reflection of business costs,

encompassing both monetary and non-monetary expenses,

within the accounts and financial statements. Consequently,

the profit figures of juristic persons tend to be lower than

those of individual enterprises.

Table 2 : Index of Potential and Growth Opportunity for Individual Medium and Small

Enterprises (2 sets of indices) in the Year 2022

nd

Small Enterprises Medium Enterprises

Index

Q1/22 Q2/22 Q3/22 Q4/22 Q1/22 Q2/22 Q3/22 Q4/22

Business Fundamental Index 0.70 0.63 0.61 0.73 0.91 0.90 0.80 0.88

Entrepreneurial Characteristics Index 0.44 0.44 0.41 0.57 0.69 0.69 0.48 0.66

Business operation Index 0.71 0.65 0.73 0.80 0.80 0.80 0.80 0.87

Business Performance Index 0.50 0.48 0.58 0.53 0.71 0.70 0.27 0.42

Potential Index and Growth Opportunity 0.59 0.55 0.58 0.66 0.78 0.77 0.59 0.71

Note : Red refers to a low level on the Potential and Growth Opportunities Index / Yellow refers to a medium level on the Potential and Growth Opportunities Index /

Green refers to a high level on the Potential and Growth Opportunities Index / Blue label refers to a very high level on the Potential and Growth Opportunities Index

ี

100 รายงานประจำาป สสว. 2565