Page 97 - รายงานประจำปี 2565 สสว

P. 97

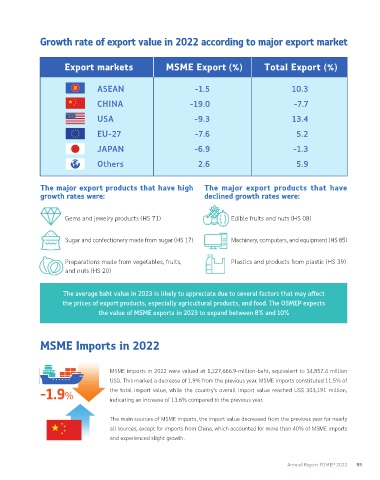

MSME Situation in 2022 by Business Size Growth rate of export value in 2022 according to major export market

Export markets MSME Export (%) Total Export (%)

Micro SEs MEs

14.1% 2.0% 4.5% ASEAN -1.5 10.3

CHINA -19.0 -7.7

Micro-businesses continued to expand SEs businesses experienced a slower MEs businesses continued to exhibit USA -9.3 13.4

as people resumed their normal lives, recovery despite the overall economic robust growth. Although MSME exports

impacting travel and spending. Measures improvement. However, issues with saw a decline of 6.0%, impacting the EU-27 -7.6 5.2

aimed at stimulating spending, such as working capital persisted, partly due manufacturing sector, businesses in

the Co-payment scheme or We Travel to the conclusion of payment waiver the trade and service sectors sustained JAPAN -6.9 -1.3

Together’ project “have contributed to measures. Many banks, including the their expansion, aligning with the

increased income for small businesses. cautious approach of granting additional overall economic recovery of the Others 2.6 5.9

Despite rising inflation, household spending credit. Furthermore, inflation led to country.

and employment also continued to grow. increased production costs for goods

The number of foreign tourists also saw and services, resulting in modest profit The major export products that have high The major export products that have

an expansion, particularly towards the increments. growth rates were: declined growth rates were:

end of the year.

Gems and jewelry products (HS 71) Edible fruits and nuts (HS 08)

MSME International Sugar and confectionery made from sugar (HS 17) Machinery, computers, and equipment (HS 85)

Trade in 2022 Preparations made from vegetables, fruits, Plastics and products from plastic (HS 39)

and nuts (HS 20)

MSME Exports in 2022

The average baht value in 2023 is likely to appreciate due to several factors that may affect

the prices of export products, especially agricultural products, and food. The OSMEP expects

• The value of goods exported by MSMEs in 2022 amounted

to 1,060,207.9-million-baht, equivalent to 30,508.2 the value of MSME exports in 2023 to expand between 8% and 10%

million US dollars. This marked a decrease of 6.0%

compared to the previous year. MSME exports constituted

10.6% of the total export value, while the country’s Export value of MSME Imports in 2022

overall export value reached 287,068 million US dollars,

reflecting a 5.5% increase from the previous year. 1,060,207.9 million baht

• The primary export markets for MSMEs in 2022 were Decrease from MSME imports in 2022 were valued at 1,227,666.9-million-baht, equivalent to 34,857.4 million

ASEAN, China, the US, Japan, and the European Union. the previous year 6.0% USD. This marked a decrease of 1.9% from the previous year. MSME imports constituted 11.5% of

These markets accounted for nearly 80% of MSMEs’

total export value. However, the value of MSME exports -1.9% the total import value, while the country's overall import value reached US$ 303,191 million,

witnessed a decline in all major markets compared to MSMEs held a share indicating an increase of 13.6% compared to the previous year.

of the total

the previous year. The Chinese market experienced a

sharp decline of 19.0% due to China’s Zero Covid measures, export value10.6% The main sources of MSME imports, the import value decreased from the previous year for nearly

while other markets were impacted by inflation, affecting all sources, except for imports from China, which accounted for more than 40% of MSME imports

both goods prices and purchasing power. and experienced slight growth.

Annual Report OSMEP 2022 95